Contents:

The only negative point in find with check 21 why your checks are clearing faster than on NSE is limited trade timing, it closes when rest of the world market opens. This low margin requirement makes it very attractive for a forex course trader. So, if any family or friend is residing outside India or a non-resident can only trade in international forex market. The Website should not be relied upon as a substitute for an extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations, or any other content is subject to change at any time without notice. “The Learning Art”, will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Nethttps://1investing.in/X online CFD and Forex platform has been developed by IFC Markets, while the latter – MetaTrader 4 is the most popular platform among traders. Both platforms have user – friendly interface, are equipped with professional tool for making technical analysis and offer automated trading for those traders that prefer using Experts during trades. The strategy revolves around acting on news sources and looking for strong trending moves with the support of high volume. There is always a forex currency the moves around 20-30% each day creating ample opportunities. The trader needs to hold onto your forex until you see signs of reversal and then get out or fade the price drop. Ensure you are well contended to access upcoming news and earnings announcements.

Session 6: Fundamental Trading Strategy: Commodity Prices as a Leading Indicator

It is a highly volatile and fast-paced market, and trading requires extensive knowledge and skill. In this course, we will cover everything from the basics of forex trading to advanced trading strategies and risk management. So without a doubt In forex trading, you can both profit and lose money. You may improve your chances of winning by moving gradually and developing a trading strategy.

Before a novice is bogged down in a complex forex world of highly technical indicators, the trader should focus on the basics of a dull day trading strategy. The notion that traders need a highly complicated strategy to succeed in forex trading, but often the more straightforward, the more effective. Position trading is a way for professional traders to take advantage of changes in the market and the world economy. It requires a deep understanding of macroeconomic indicators, geopolitical events, and other things that can affect the value of a currency.

A breakout FX trader enters into an extended trading position after the currency breaks above resistance. The trader can still open a short position once the currency breaks below support. So, after the currency trades beyond the specific price barrier, forex volatility typically increases, and prices will often shift in the direction of the breakout. Swing traders also need to be disciplined and patient, so they can find the best entry points and make the most money. With a well-defined strategy, it can be an effective way to take advantage of short-term market movements and make consistent profits over time. Professional traders like this strategy because it can be very profitable, but it also comes with a lot of risk.

Swing trading involves holding positions for a few days to a few weeks. The goal of swing trading is to profit from short-term price fluctuations while avoiding the noise and volatility of intraday trading. Professional traders use swing trading to take advantage of trends and market sentiment. To find potential opportunities and handle risk well, it’s important to know a lot about technical analysis and the basics of the market.

Buy Books Online, Largest Book Store in India

These are over the counter trades, So, no stock exchange is involved and it is open 24 hours a day. You can find a lot of registered foreign forex dealers with foreign marker regulators. Most of them offer trading on Meta Trader 4 or Meta trader 5 trading app.

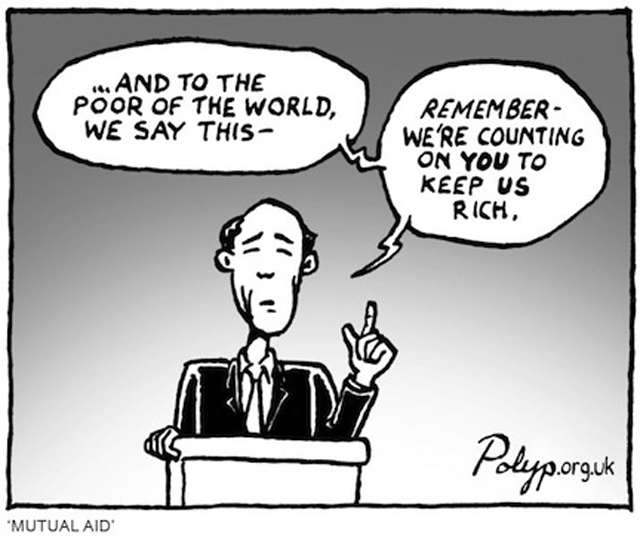

In this two-book bundle, you’ll learn the not-so-secret strategies that rich people use to constantly, predictable, and safely grow their wealth as they sit back and watch the numbers increase. Hedging is a risk management strategy that involves opening two or more positions in opposite directions. The goal of hedging is to protect against potential losses by offsetting the risk of one position with another.

If you’re looking to take your forex trading to the next level, you need to go beyond the basics and learn advanced strategies. Professional traders have a wealth of experience and knowledge that can help you become a better trader. In this article, we’ll take a look at some of the best advanced forex trading strategies that professional traders use.

Best Forex Trading Coaching Institute in Chennai

Trend and breakout forex traders can use pivot points to locate critical standards that need to break for a trade move to count as a breakout. The strategy looks at capitalizing on minute price changes with quantity being the driving force. The trader seems to sell as soon as the trade becomes profitable, which is a fast-paced and exciting way to trade although risky. There is a need for a high trading probability to rule out the low risks vs. reward ratio. The trader needs to be on the lookout for volatile instruments, attractive liquidated forex and hot on timing. In case of losing trades close don’t wait for the market tight as soon as possible.

- Trend and breakout forex traders can use pivot points to locate critical standards that need to break for a trade move to count as a breakout.

- The goal of position trading is to profit from long-term trends and macroeconomic factors.

- However, if you are an Indian resident as per FEMA guideline and RBI Notification, it is not legal to send or receive rupee/dollar transaction overseas for online forex trading.

- Ensure you are well contended to access upcoming news and earnings announcements.

- It is highly volatile, so you can quickly sell when needed without being stuck with assets that have declined in value.

The strategy is vigorously debated and potentially dangerous when applied by beginners, although it is used all over the financial world market. Its commonly termed as trend trading, where a trader pulls trending and mean reversion strategy. Reversal strategy defies basic logic as you aim to trade against the trend and the trader needs some skills to identify possible pullbacks accurately, plus predict their strength. Reversal can be achieved using in-depth market knowledge and experience.

Forex Trading Course in Dubai

A consistent trader has an advantage over traders who do not trade regularly or trade without a plan. Having solid market knowledge is a must, and one should have a clear understanding of how things function here and what might lead a trader to success. Novice traders can also become great forex traders by learning the strategies used by expert traders. Novice trading strategies are essential when one is looking to capitalize on frequent, small price FX movements. A high number of consistent, effective trading strategies based on in-depth technical analysis, using FX trading charts, patterns and indicators to predict future price movements.

Swissquote offers a chance to earn passive income with trading accounts – CryptoNewsZ

Swissquote offers a chance to earn passive income with trading accounts.

Posted: Mon, 01 May 2023 13:30:13 GMT [source]

Foreign exchange trading, also known as Forex trading, can be a great way to invest and make money. It has low costs compared to stocks and other investment tools and can often create higher returns. With its 24-hour markets, traders can find certain advantages due to the different time zones that cycle on any given day. The breakout strategy is based on when the price clears a specified level on your chart,with increased volume.

Easy Forex Trading Course for Beginners in Tamil

When you trade on news, you take advantage of changes in the market that are caused by important economic or political events. Professional traders closely monitor news announcements and data releases and take positions based on their predictions of how the markets will react. Professional traders use hedging to mitigate risk and protect their investments. But it’s important to remember that hedging doesn’t guarantee profits and can also limit the amount of money you could make. As a result, only seasoned traders who know how to manage their positions and evaluate the risk-reward ratio of each trade should use it. The Forex Trading Advance Course is the next step if you’re looking to achieve consistent profitability.

Bitsgap Offers Crypto Trading Bots With Advanced Features: Review – U.Today

Bitsgap Offers Crypto Trading Bots With Advanced Features: Review.

Posted: Wed, 26 Apr 2023 15:16:34 GMT [source]

Professional traders use these and other advanced forex strategies to make the most money and take the least amount of risk. It’s important to remember that trading is inherently risky and requires discipline, patience, and a deep understanding of the markets. By learning from the experts and developing your own style, you can become a successful and profitable forex trader. Forex trading is the buying and selling of currencies on the foreign exchange market with the aim of making a profit.

Factors Affecting Forex Prices

The article is meant to give a novice a thorough breakdown of beginner trading strategies, looking to advance to full-time forex traders, automated and even FX specific strategy. Basic forex trading strategies include incorporation of the invaluable elements such as money management, time management, start trading small, and most of all forex timing. The above features can be mastered using a forex trading demo account.

In general, forex trading is the buying and selling of currency pairs in which the value of one currency is determined by the price of another. Commodities like gold and oil have an important connection to the FX market. Understanding the nature of these relationship can help traders gauge risk, forecast price changes, and understand exposure. Even if commodities are unfamiliar, they will often move on the same fundamental factors as currencies, particularly when it comes to popular instruments such as gold and oil.

- Professional traders use hedging to mitigate risk and protect their investments.

- There is always a forex currency the moves around 20-30% each day creating ample opportunities.

- To find potential opportunities and handle risk well, it’s important to know a lot about technical analysis and the basics of the market.

- Even if commodities are unfamiliar, they will often move on the same fundamental factors as currencies, particularly when it comes to popular instruments such as gold and oil.

- Novice traders can also become great forex traders by learning the strategies used by expert traders.

NetTradeX and MetaTrader 4 online trading platforms are available for various operating systems from which you can choose. Each of them delivers rich functionality and convenient environment for trading and making market analysis. Alongside with the most popular trading platforms MetaTrader 4 and 5, IFC Markets offers you to assess the advantages of its own professional trading terminal NetTradeX. Ultimately, you will need to find a novice trading strategy that suits your specific trading system and requirements. Risk reversals are a useful fundamental-based tool to add to your mix of trading indicators. One of the weaknesses of currency trading is the lack of volume data and accurate indicators for gauging sentiment.

When it comes to forex, one of the most important things to know is that currencies do not trade in a vacuum. In many cases, foreign economic conditions, interest rates, and price changes affect much more than just a single currency pair. Here, is a detailed comparison between trading on NSE and Internation Markets.

When used correctly, however, it can be a powerful tool for managing risk and maintaining profitability. However, all major currency in world market like USD, EUR, JYP, CHF, AUD, CAD are Free floated and there is almost no intervention. NSE introduced three cross currency derivatives EURUSD, GBPUSD and USDJPY in Feb’2018. – For Cryptocurrency, we will provide any of the btcusd bitcoin or other coins trading ideas. – For Forex currency pairs, we will provide any of the major and cross pairs trading ideas.

The Learning Art E-books and Education Centre is a market raining base that can equip any individual and novice traders with the basics of the stock market and forex market investments. The Learning Art E-books and Education Centre is a market training base that can equip any individual and novice traders with the basics of the stock market and forex market investments. The two most popular and advanced Forex trading platforms to choose from are NetTradeX and MetaTrader 4.